As the temperatures we reached in the UK this summer have demonstrated, we can no longer ignore the effects of climate change and the contribution real estate plays.

The scale of your commitment to the solution will depend on how your values chime with the statement that businesses exist for the benefit of all stakeholders, not just those who own shares.

If your business recognises it has a duty to serve customers, employees, suppliers and communities, you will read on to discover if our views are aligned. If you don’t, you probably won’t have made it this far.

I have long held the view that reducing your carbon impact, or moving to net zero, makes commercial sense. As the recent unpleasantness in Ukraine has shown, this was quite prophetic. But to be honest, I had always thought mitigating regulation rather than a global spike in energy prices not seen since the year I started Primary School in the 1970s was the reason.

The firms that have adopted a genuine sustainable culture that we work with at Locate in Kent have been innovative in every aspect of their business as they strive to improve. By recognising that they must be a force for good in this area, they have adopted the same approach to meeting customer needs, retaining colleagues and improving productivity.

With our built environment responsible for circa 40% of global carbon emissions, the clearest proponents of seeing the commercial value of sustainability are industrial property developers. All large new sheds built in our region over the last 3 years are BREEAM Good or Excellent. Not purely because they buy into the value of sustainability, but because the institutional investors that acquire the let buildings expect it. They won’t invest without the confidence the building will be both compliant and marketable over the long term. Financing is driving their change.

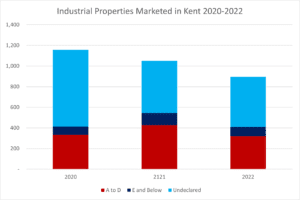

The difficult proverbial tanker to change in direction is the existing building stock. As our chart shows, the number of buildings being marketed fell by 22% over the three years up to 30 June 2022. However, the number of spaces below and EPC rating of D or with undeclared in the marketing materials available have remained stubbornly high. Product with an EPC of A to D has fallen as a proportion of those marketed buildings, from 36% to 29%. That’s because there is greater demand for higher performing buildings.

While we accept this may not be conclusive, Gerald Eve’s recent findings should be. Their research suggests over a third of multi-let industrial floorspace in London and the South East will need improvements in the next five years to comply with minimum energy efficiency standards. In the immediate term, 2% of the industrial market in London and the South East have EPCs of ‘F’ or ‘G’ and without improvements, will fall below the required standard by April 2023.

We looked at the EPC Open Data lodged by local authorities for industrial sites in Kent for use classes B2-B7 and B8 in the 10 years to 30 June 2022 to validate this.

Our analysis shows that around 1 in 10 of EPCs on industrial stock within Kent in the ten years to June 22 have had an ‘F’ or ‘G’ rating – below the minimum requirement. When we drilled into the schedule of certificates lodged for just last year, we found that less than 1% were certified as below the minimum requirement. In our minds, this is a positive sign that things are moving in the right direction.

So combined, these data points start to build our case that moving to net zero makes commercial sense, whether you are an owner occupier, tenant or landlord. With 57.6% of the need for improvements in London and South East being in small industrial units, to keep the market fluid, we have a clear need to invest in building upgrades; to offset higher fuel costs, comply with regulation and hold a future-proofed asset for future disposal. Not to mention, fulfil our obligation as a business to serve all our stakeholders.

Finally, please don’t think you are alone if you are reticent to sink hard-earned cash into your buildings. Our Open Data analysis of the EPC register found only 36 out of 3,491 of businesses voluntarily obtained a new EPC in our region. 99% of businesses are seeking them to sell or lease a building or because they are newly built. So, to be clear, not acting now means you are only delaying the inevitable.

Simon Ryan is our Investment Director. He works with businesses and property developers to make Kent an even more appealing place to work and grow businesses. Click here for his contact details >>