Closure of high street stores has coincided with the trend towards online sales growth further in 2021. The pandemic has accelerated long-term structural growth drivers and all the evidence suggests that online rather than instore sales remain strong and resilient beyond 2024. Retailers and their logistics partners have invested further into warehousing capability to meet demand and satisfy consumer’s expectations for next day service and will continue to do so until online demand plateaus.

Figures published by Altus last month showed 49 brand new large distribution warehouses were built in 2020. The space Altus claims is equivalent to over 190 full sized football pitches, and roughly the same amount of physical space lost by the Boohoo and Asos acquisitions of Debenhams and Arcadia.

Almost 15m sq. ft. of new “super sheds” built across the UK in 2020.

While the “Golden Triangle” in the East Midlands (from Northamptonshire to East Midlands Airport and Tamworth) saw the biggest increases, there is a race for more space in London and the populous Southeast Area too. Big box logistics have continued to do well in Kent, fuelled by the drive for delivering ecommerce to London. After all, no part of the UK is better connected to supply chains in Europe and beyond with high speed trains, short ferry crossings and a vast choice of ports offering unaccompanied freight services.

Equally, occupier and investor demand for logistics properties in Europe is strong and recent research by Tritax, shows it will continue to be for at least the next three years. Led by the major French, German, Spanish and Italian markets where sentiment is positive and like the UK, adequate supply of new warehouse space is the top challenge for the logistics sector. European logistics real estate take-up by occupiers in the first half of 2021 was 60% above the average for the same period over the last 10 years. Vacancy rates also fell to a record low.

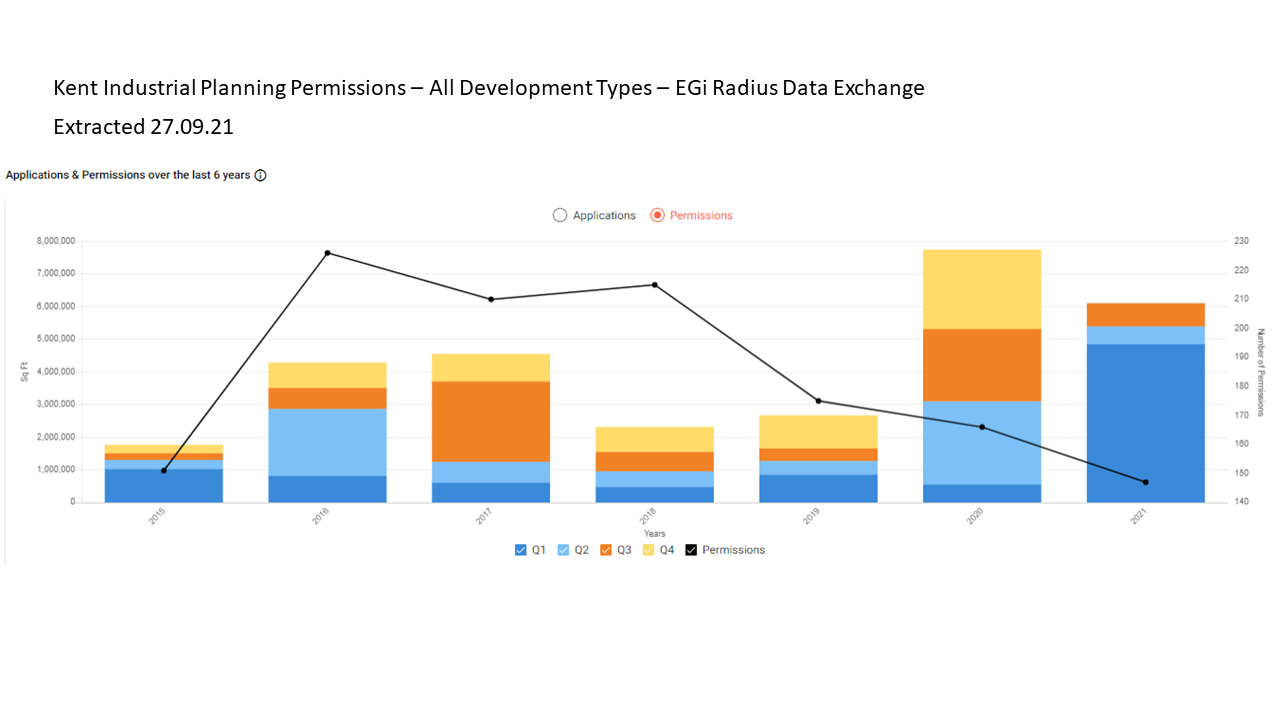

As much as I’m an advocate the large sheds coming out of the ground across Kent generating large job numbers, I’m minded we monitor the balance of new industrial facilities coming forward. As our chart based on EGI Radius data shows: as the number of planning consents have fallen in the region since 2016, the size of the space consented has grown. That means large sheds are being favoured over smaller facilities.

Industrial space in the Southeast is already under pressure from residential development. As communities grow to meet the Government’s housing targets and new large residential developments come on stream such as Otterpool, Ebbsfleet Whitecliffe and Hoo Peninsula, we must bring the new types of commercial space in parallel. But not just big sheds.

You don’t need me to point out that in the markets where supply is most constrained, there will be sustained upward pressure on rents and ongoing yield compression. Landowners will be over the moon about the current state of the market, but they won’t be able to realise those gains, unless local planning authorities come to the market too. As I have set out in previous articles, LPAs must recognise that we consume in new ways. We need Local Plans to reflect how we shop online and consume at home and for that to happen, superfast broadband and local distribution facilities are the prerequisites for the last few miles of delivery that connect with those big box schemes.

So are small units for local businesses. As more businesses move to the region from London to make way for last mile logistics or residential schemes, they need suitable property to ensure their business growth can continue. With the cost of capital still low, Locate in Kent sees the imbalance in demand for small businesses seeking investment in their own real estate to bake in resilience for another shock like a pandemic, and the investment from institutional investors via developers offering long term lease facilities. For small businesses to thrive, some need to ensure capital is used in their bricks and mortar, especially when they are investing in once in a lifetime plant and machinery purchases to be held in it.

High streets will continue to decline as we consume more from home. To ensure there are sufficient jobs to replace those lost in shops, hospitality and personal service, we must have more space for businesses to develop. Not just the big sheds that hold all the stuff we can now order at a click of a button, but also the small firms that are the backbone of our economy.

Simon Ryan is our Investment Director. He works with businesses and property developers to make Kent an even more appealing place to work and grow businesses. Click here for his contact details >>